Share Market investment was a world which many believe was restricted solely to the rich investors and not available for the general public. Besides, this barrier existed for a number of reasons. The first was finance. People just did not have the economic means to purchase a share that was very pricey, in a large enough quantity, to be profitable. Secondly, was the general mentality.

The share market was always rightly perceived as a risky venture and the general public who did not have enough money to risk without losing their safety net simply found safer investments to be more lucrative. Further, there was also a mentality that only those who are well versed with business, or have a lot of skills and education in commerce and finance can be the ones who can read the market properly and invest. Most if not all of these concerns have been largely mitigated in the share market of today as we see an anomaly in share market trends.

Read more: Long Term Investment Ideas in Indian Stock Market

There is an ever-growing exodus of young thrifty and profit-seeking young minds who are suddenly entering this market with money to spend. Suddenly, the ground on the rich and elite is now filled with the ‘Internet’ era people. Why did this happen? What does it look like? What does the future hold along with other trends? This article will clear all such questions and doubts about the stock market of today.

Stock Market 2021:

Surprisingly enough, the continued pressure of the pandemic in 2020 invited a huge pour-in of rookie and small-time investors. The general belief was that the economical damage will be a detriment for people from investing who would rather use that money to survive their basic needs.

However, what was observed that a huge amount of urban youth, especially in the USA, when they received their stimulus checks, poured in these few thousand dollars not into food and shelter, but rather into investing. Suddenly, there is a trove of people downloading popular trading apps such as Robinhood.

Read more: Stock Market Tips: Learn Why & How to Invest in Stock Market

The next big rush was in 2021. In January 2021, a failing company, GameStop fell victim to short-selling hedge funds. But then the power of the internet United, as users of a popular social media Reddit, belong to a group called WallStreetBets banded together to revive the dying share. With each passing day, thousands of dollars started being poured into GameStop to save its share value, which ended up creating a short squeeze for the hedge fund short sellers who faced massive losses.

This event was largely perceived as the general public using the power of trading and market principles to fight back against mega corporations which used to control and bully the share market. After this incident, there was a Eureka moment where people realized that they too could cash in on the massive profits that the share market can potentially offer.

Read more: 7 Tips To Invest In Stock Market in India with Little Money

And within days, people with whatever earning they had, throughout the globe, became overnight pocket investors. Gone were the days of lengthy financial analysis and large funds, now people could invest in the share market with just their phones.

Stock Market 2020:

One must wonder why these incidents opened up a rather exclusive community to the larger public. The share market was never closed off formally to the people at large. It was always the case that anyone who wanted could buy and sell a share. But what changed was the ideology of the people.

Stock Market 2021 Predictions and Trends:

In the aftermath of these share market investment trends, people realized that the everyday citizen who has an average income and savings could also gamble on the stock exchange. The community of young investors bolstered each other with positive messages signaling that even the smallest shareholders matter and showed that many small people coming together could also topple the rich and mighty.

Read more: Top 10 Best Share Market Websites

A secondary reason is a convenience that trading apps have brought. Providing simplified graphs, data, and analysis on the performance of share, gave everyone just enough information they need to confidently invest. Apps such as WeBull, Fidelity Investments, Robinhood, and Ameritrade are leading the digital charge for being popular online share exchanges.

Obviously, seeing the profits to be made, everyone now wanted in on the pie, which created the current bull rush we’re seeing today. It is thus no surprise that even when national economies are struggling to revive and fight the pandemic, the stock market is as healthy as ever, riding on the backs of these new young investors.

2020 Stock Market Lessons from past for 2021:

The share market trends in 2020 show that investing in the share market is relevant for every single person. Many people were able to utilise their stimulus cheques and then spend that money on share markets. A few months later, they were all financially independent.

Read more: What Are the Technical Methods for Determining the Best Stock Market Tips?

The main takeaway here is that the share market is a game of finding the right opportunity. Because of the naturally risk nature, it discourages a lot of people, but smart investing can help you mitigate s lot of these risks.

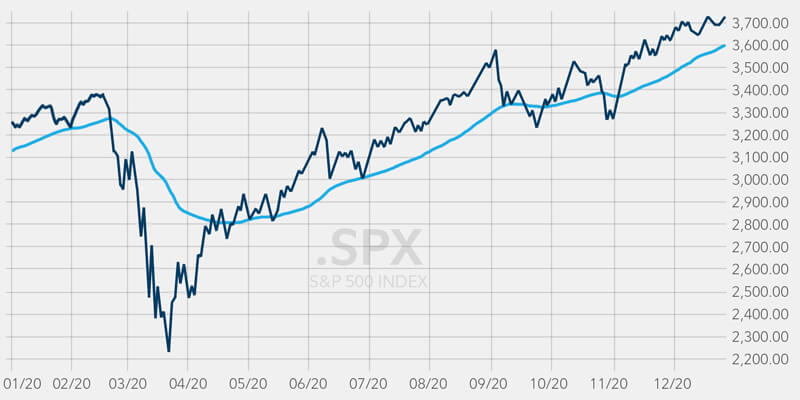

In 2020 when the stock prices were at an all time low, this became the perfect oppurtunity to buy into many popular shares, as most businesses were bound to recover once global lockdowns eased up. Many unicorns and gems in the medical and technology industry also started up and soared in the market. The people who were channel some of their savings into these dips were able to buy very cheap. And now they’ve very profitable.

Now that we’re in 2021, this increased trading activity as well as the recovery of many businesses led to an increase in share prices which was a gain for all the investors in 2020. However, this does not mean that the gold rush is over. Now is still a great time to enter trading because the market is as healthy as ever. Sure it might be rarer, but the opportunities if multiplicative growth is still present if you tactically search for the right stock.

How to pick a stock:

Great, you have decided you will finally download that app and enter the trading world. But the next biggest question is how to decide which share you will purchase. This is a very critical stage as this first purchase often makes or breaks your motivation to be a stock market investor. Go with the expectations that you might face losses, but still be optimistic so that you can observe what to buy and when to sell.

Deciding the right share to purchase involves a few factors. Firstly, look at the history of the company. Long lasting prestigious companies often are low risk low return ventures because of their relatively stable and low deviation shares. Such options are great for long term stock holding. If you are more into day trading or frequent trading a great indicator is to check the performance metric of the stock over various periods of time.

Many of the stock listing websites also provide these graphs. Finally, the last way to judge a share’s value for you is to do financial analysis to estimate the performance of this stock. Although you can apply complex commercial mathematics formulas and models to do it yourself there are many applications and tools that make the job easier for you.

What is the tool we can use to find market analysis for stocks?

Some of the most popular stock analysis tools right now are Ziggma, Finviz, and TradingView. Such tools can be found all across the internet!

How these tools work?

Market analysis tools give you a lot of information about the stock market shares in the following ways:

- Stock screeners: This feature shows you the aggregate information of the various stocks available in the market. This includes their trading volume, prices, and growth rates. You can also filter them using various factors such as minimum/maximum price.

- Charting Software: Charting softwares are responsible for creating a graphic chart of the performance of the share over a period of time or based on an index. Studying data charts is one of the best ways to judge performance.

- Stock Simulator: These stock simulators are able to give you a virtual currency to practise share trading with. They use real world data and are great practice for those who are a bit doubtful about putting in their money into the market immediately because of inexperience.

- Trading Newsletter: Newsletter can be found online or through the mail. Basically Trading Newsletter provide you well written, insight driven articles on the stock market trends. These articles can have a more general and holistic opinion. There are many articles that also specifically analyse a particular share or company’s performance. Newsletters keep you up to date with the upcoming trends and developments of the stock market world.

Stock Market Forecast 2021; Investor Optimism:

The current Share market investment trends point to there being a bull rush. A bull rush is a situation where many people are buying shares and the market is bullish. This bull rush is being caused by an all-time low in the share market prices that make investments more lucrative, as well as a massive inflow of new young investors looking to buy shares and entering the world of trading.

Read More: 15 Best Trading App for Online Stock Trading

It is expected that this increases trading behavior will sustain itself through the remainder of 2021, with a natural market recession soon to follow. It is yet to be seen if the transition to a bearish market where everybody is selling and stock prices are falling will deter the new investors.

This kind of stimulated trading activity is a proof of Investor Optimism, as more and more people are willing to enter into and trade in the stock market. Not only this, the activity is also becoming more lucrative and engaging for traders who were already there in stock market for multiple years in the past.

In summary, the part that needs to be looked forward to is the fact that there is finally a disruption in the established big players of the share market industry. The finance Moguls are no more the ones controlling the entire market, and now the common man has equal power to compete.