Last Updated on 22/03/2022 by Deepak Singla

Did your tax-saving plan get jeopardized due to the current pandemic?

Don’t worry! You can still invest in some tax-saving Mutual Funds, i.e. the ELSS funds until the 31st of July and claim your tax deductions for the last fiscal year. People keep looking for best investment Plans to grow their wealth and also save on their taxes at the same time. ELSS schemes are such funds that help you in saving taxes and generate returns as well.

Apart from that, ELSS funds allow you to build a large corpus if you stay invested in them for the long term and thus, fulfill your financial goals. In this article, we will talk in detail about the ELSS (Equity Linked Savings Scheme) mutual funds. After you are done reading this page, you will get to know everything that you should know about ELSS mutual funds.

In the article

Tax Saving Mutual Funds

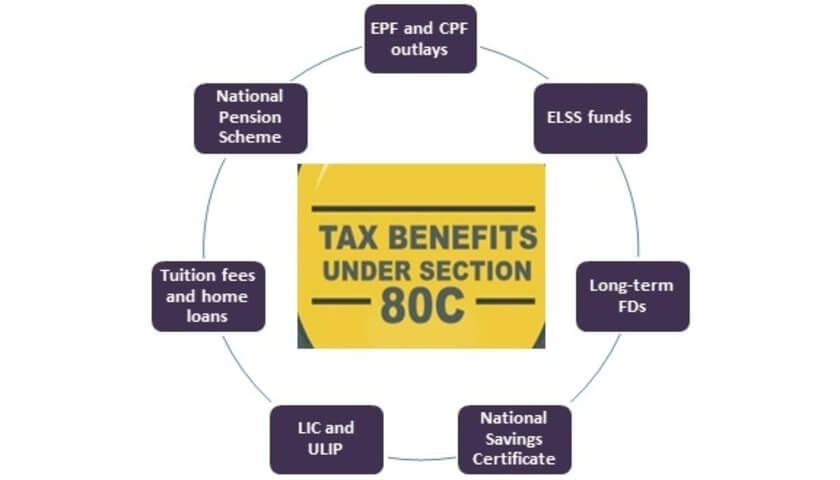

Tax Saving Mutual Funds are the equity-oriented mutual funds that qualify for tax deduction under Section 80C.  These are also known as Equity Linked Savings Scheme or ELSS and are open-ended equity mutual funds.

These are also known as Equity Linked Savings Scheme or ELSS and are open-ended equity mutual funds.

- With ELSS funds, you can save up to INR 1.5 lakhs.

- You will get a tax exemption for an amount up to INR 1.5 lakhs on your annual taxable income.

- The lock-in period of such funds is 3 years which is less than those of other investment options under section 80C.

- The average returns of ELSS tax saving mutual funds for the last 3 years have been about 15%. So, this is a better option when compared to Fixed Deposits and PPF.

ELSS Mutual Funds

ELSS Mutual fund is a type of equity fund that invests at least 80% of their corpus in equity  and related instruments as per the SEBI instruction. These are also known as tax-saving mutual funds since they provide investors with a tax exemption of INR 1.5 lakhs (max.) on your annual income as per Section 80C.

and related instruments as per the SEBI instruction. These are also known as tax-saving mutual funds since they provide investors with a tax exemption of INR 1.5 lakhs (max.) on your annual income as per Section 80C.

Types of ELSS Mutual Funds

You can choose from two types of ELSS Mutual Funds:

- Dividend Scheme: With this scheme, you will receive extra revenue in the dividend form from time to time. These dividends are declared by the fund house. These can be withdrawn or even reinvested in the fund and are not subject to tax or the ELSS lock-in periods.

- Growth Scheme: This scheme produces long-term capital gains for the investor. You can redeem these after the maturity period.

List of Top 10 Best ELSS funds for Tax Saving

[table id=4 /]

1. Canara Robeco Equity Tax Saver Fund

Canara Robeco Equity Tax Saver Fund has provided an annualized return of 9.02%. It aims to produce capital gains on a long term basis via equity investment.

This fund offers tax benefits as well under Section 80C of the Income Tax Act. The minimum lump sum and SIP investment of this fund are INR 500.

| Minimum Investment | INR 500 |

| Annualized returns | 9.02% |

| AUM | INR 992 Crs |

| 1 yr returns | 3.65% |

| 3 yr returns | 7.27% |

| 5 yr returns | 7.52% |

| 2019 returns (%) | 11.30% |

2. Quant Tax Plan

Quant Tax Plan had delivered 2.55% returns in the last year and annualized returns of 4.15% in the last 3 years. It has consistently delivered better performance than its competitors. The minimum investment in a lump sum and SIP options in this fund is INR 500.

| Minimum Investment | INR 500 |

| Annualized Returns | 4.15% |

| AUM | INR 10 Crs |

| 1 yr returns | 3.85% |

| 3 yr returns | 4.5% |

| 5 yr returns | 10.95% |

3. Invesco India Tax Plan

Invesco India Tax Plan has provided 5.84% annualized returns for the last 3 years. It has consistently hit its benchmark index. Last year, it delivered 1.39% returns.

These funds invest along with a long term perspective in various market capitalization and sectors. It makes use of the bottom-up approach when it comes to stock selection.

Besides, the Invesco Tax Plan also makes use of stock selection, capitalization bias, and sector allocation for alpha generation.

| Minimum Investment | INR 500 |

| AUM | INR 997 Crs |

| Annualized returns | 5.84% |

| 1 yr returns | 2.02% |

| 3 yr returns | 5.9% |

| 5 yr returns | 7.99% |

| 2019 returns (%) | 10.83% |

4. Axis Long Term Equity Fund

Axis Long Term Equity Fund has provided very strong performance ever since being launched. It has outperformed other similar funds over the years and continuously hit its benchmark equity. Hence, this fund has found a spot in the top 10 ELSS mutual funds list.

This fund has consistently provided 7.72% annualized returns in the last year. The minimum lump sum and SIP investment for this fund are INR 500.

| Minimum Investment | INR 500 |

| AUM | INR 20,292 Crs |

| Annualized returns | 7.72% |

| 1 yr returns | -1.41% |

| 3 yr returns | 6.69% |

| 5 yr returns | 7.91% |

| 2019 returns (%) | 15.34% |

5. Kotak Tax Saver Fund

Kotak Tax Saver Fund is yet another open-ended savings scheme that invests majorly in equity and other related schemes. It was launched by Kotak Mahindra Mutual Fund and was launched in November 2005.

The revenue generated via this scheme is completely tax exempted. The gains are generated via a diverse investment portfolio consisting of equity and other related schemes.

| Minimum Investment | INR 500 |

| AUM | INR 1133 Crs |

| Annualized returns | 15.34% |

| 1 yr returns | -2.4% |

| 3 yr returns | 3.23% |

| 5 yr returns | 6.955 |

| 2019 returns (%) | 15.07% |

6. DSP Tax Saver Fund

DSP Tax Saver Fund makes use of the multi-cap strategy of investment for a long investment tenure. This fund follows a mix of top-down sector allocation approach and the bottom-up stock selection approach.

It selects stocks via an analysis of valuation support. Also, it invests in emerging as well as established business firms that give you stability along with growth.

For the last 3 years, it has delivered 3.29% annualized returns and its last year’s returns were -2.45%.

| Minimum Investment | INR 500 |

| AUM | INR 5,789 Cr |

| Annualized returns | 3.29% |

| 1 yr returns | -1.44% |

| 3 yr returns | 3.53% |

| 5 yr returns | 7.87% |

| 2019 returns (%) | 15.82% |

7. BNP Paribas Long Term Equity Fund

BNP Paribas Long Term Equity Fund has provided an annualized return of 6.41%. This scheme aims to generate capital gains over a long investment horizon. Its investment portfolio is actively managed and is invested in equity and other equity-related instruments.

| Minimum Investment | INR 500 |

| AUM | INR 425 Crs |

| Annualized returns | 6.41% |

| 1 yr returns | 2.31% |

| 3 yr returns | 3.59% |

| 5 yr returns | 5.1% |

| 2019 returns (%) | 14.69% |

8. Aditya Birla Sun Life Relief 96 Fund

Aditya Birla Sun Life Tax Relief 96 Direct-Growth fund has consistently hit the benchmark in its equity segment for quite some years now. For the last 3 years, it has provided 3.22% annualized returns. Its returns for the last year were at 0.78%. This is why it has been one of the top tax saving mutual funds for quite some time now. It was also one of the best ELSS tax saving mutual funds of 2019.

This fund invests in a diverse portfolio of equity and other related instruments. It was launched by the Birla Sun Life Mutual Fund and was transformed into an open-ended scheme in March 1996.

| Minimum Investment | INR 500 |

| AUM | INR 10,101 Crs |

| Annualized Returns | 3.22% |

| 1 yr returns | 1.35% |

| 3 yr returns | 3.31% |

| 5 yr returns | 7.29% |

| 2019 returns (%) | 4.83% |

9. Tata India Tax Savings Fund

Tata India Tax Savings Fund was launched back in March 1996 by Tata Mutual Fund. It is an open-ended savings scheme that invests in equity and related instruments. It has the aim of producing long-term capital growth and also offers tax exemption under Section 80C of the IT Act 1961.

| Minimum Investment | INR 500 |

| AUM | INR 1855 Crs |

| 1 yr returns | -6.24% |

| 3 yr returns | 2.6% |

| 5 yr returns | 7.99% |

| 2019 returns (%) | 13.77% |

10. Motilal Oswal Long Term Equity Fund

Motilal Oswal Long Term Equity Fund has delivered 0.7% annualized returns for the last 3 years. This fund is one of the best ELSS funds in India as it has consistently hit its benchmark index.

It provided -3.24% returns in the last year. The minimum lump sum and SIP investment you need to make in this fund are INR 500 only.

| Minimum Investment | INR 500 |

| AUM | INR 1497 Crs |

| 1 yr returns | -3.01% |

| 3 yr returns | 0.86% |

| 5 yr returns | 8.22% |

| 2019 returns (%) | 13.14% |

Features of ELSS Mutual Funds

- ELSS fund invests in equities in a varied fashion. It invests across various market-capitalizations, sectors, and themes.

- They don’t have any maximum investment period. But, they do have a mandatory lock-in period of 3 years.

- Under ELSS Mutual Funds, at least 80% of the entire investible amount is invested in equity and other equity-related funds.

- You will get a Tax-exemption on your investment under Section 80C of the IT Act. Your annual income is treated equivalent to LTCG. So, it is taxed as per the already existing taxing rules.

- There is no upper limit to investing in ELSS, unlike other investment options like PPF and NSC.

- Investment in ELSS can be as low as INR 500 only. You can opt for this if investing a large sum is not affordable for you.

- The investments worth INR 1 lakh are only eligible for tax benefits.

- ELSS funds are a type of mutual fund, so these too are subject to market risk. Now, the market risk depends on where these funds are invested and can be low, medium, or high.

- ELSS schemes also provide you with nomination facilities

- More or less all the ELSS tax saving funds have entry and exit loads. Such fees are charged by the providers as the fee for the purchase, redemption, sale, and transfer of the fund units.

Benefits of investing in ELSS funds

- Tax Exemption: You will be able to avail of a tax exemption of up to INR 1.5 lakhs under Section 80C of the Income Tax Act.

- Long-Term Gains: Besides, the ELSS investments have a mandatory lock-in period of 3 years. So, you will receive long-term capital gains (LTCG) when you redeem the units. This LTCG are exempted from taxes up to INR 1 lakh per fiscal year.

If you receive more LTCG, i.e. above this limit without indexation, then it will be taxed at the rate of 10%.

- Helps to achieve long-term financial goals: You can invest in these schemes to plan for your future financial goals. These goals could anything like paying off the house loan, child’s education, buying a car, and more.

- Monthly Investment: If you can’t afford to invest a large sum at once, then you can also opt for a monthly investment. This is possible via SIPs, i.e. Systematic Investment Plan.

- Diversification: In order to minimize the risk of incurring a huge loss, the best ELSS plans do not invest all their portfolio assets in a single place. Instead, your portfolio investment will be diverse to decrease the associated risk.

Most of these funds will invest your money in various companies ranging from small to large-cap companies. The sectors invested in will also be diverse and hence, your overall investment portfolio will become diverse.

- Earn dividends: During the lock-in tenure of 3 years, you won’t be allowed to withdraw the invested amount. But you will receive and will be able to withdraw the dividends earned.

- Shorter lock-in tenure: ELSS mutual funds come with a lock-in period of three years only. But, other investment tools generally have a lock-in tenure of 6 to 15 years. Hence, the ELSS lock-in period is way shorter than those of other funds.

- Open-ended schemes: These schemes are open-ended, so you can invest throughout the year.

- A layman can safely invest: ELSS plans are managed by experienced fund managers. They have proper and in-depth knowledge of the markets. So, people who have minimal to zero market knowledge can invest in these funds.

- Savings: You can also choose ELSS funds as a savings option. Also, you can decide to stay invested even after the stipulated lock-in period of 3 years. If you do not withdraw your principal sum after that, then it will keep growing to a massive amount of corpus.

Why should you invest in ELSS funds?

We have already provided you with the benefits of ELSS tax saving mutual funds.

Keep reading to find the main reasons as to why you should consider investing in ELSS mutual funds.

Keep reading to find the main reasons as to why you should consider investing in ELSS mutual funds.

- Better Returns: Equities, when thought of as an overall asset class, are very volatile in nature. But, this statement is valid for the short term only. Usually, equities end up beating other asset classes such as FDs, when you invest in them over the long-term.

As ELSS invests at least 80% of your portfolio in equities, they have the capability to produce higher returns when compared to other investments under Section 80C. For instance, ELSS returns are better than those of Public Provident Fund (PPF), Fixed Deposits (FDs), and National Savings Certificate (NSC), etc. in the long run.

- Shortest lock-in tenure: As we have already mentioned, with ELSS funds, your investment will be locked-in for 3 years only. This is the lowest lock-in tenure among all the tax-saving investment options eligible under Section 80C.

The lock-in tenure of NSC and fixed deposits is 5 years. While for PPF, the lock-in period is 15 years and for ULIPs, it is 5 years. Hence, ELSS has the shortest lock-in period of just 3 years.

- Great Investment Tool: ELSS mutual funds have the greatest potential for generating wealth over the long-term. So, it is a great option for amassing wealth which could fulfill your long-term financial goals like Retirement Savings, Child’s education, marriage, etc.

- Provides Flexibility to Fund Manager: Lastly, the 3 year lock-in period further eases things out for your fund managers when the markets are volatile. They receive the flexibility to consider a long-term look at the market volatility with respect to all other open-ended investments.

- Minimum Investment: Almost all the ELSS schemes have the option of starting the investment with as low as INR 500. So, you do not necessarily need to amass a great corpus to start investing in ELSS.

- SIPs or Lumpsum Investment: You can choose to invest a lump sum amount or via SIP in ELSS mutual funds. If you want to invest in small amounts, then you should go for SIPs. This way you will get an opportunity to create wealth along with being able to save on taxes.

How to Invest in the Best ELSS Funds?

The method of investing in ELSS funds is the same as that of mutual funds. The easiest way to do so is through an online application. You can choose to invest a lump-sum or invest via SIP.

We have listed the step-by-step procedure of investing in an ELSS mutual funds below:

Step 1. Analyze your tax slab and your taxable income as well. This is necessary to be able to use your ELSS scheme to the maximum level to save as much as possible on your income.

You need to know your taxable income first and then decide upon an investment amount accordingly. For instance, people under the maximum tax bracket can also save up to a maximum of INR 45,000 on their taxable income, via ELSS investment.

Step 2. Select the tax-saving fund that will suit you. This is the most important step in the investment procedure. ELSS funds are mainly tax saving mutual funds but the ELSS returns might not be good despite being tax efficient. So, choose a fund that will save you tax and also offer good returns.

Step 3. Choose any one from the options of regular mutual funds and tax-saving mutual funds.

Step 4. Open an ELSS bank account.

Step 5. Pick your intermediary who will manage the fund. You can also directly invest at a mutual fund company but investing via an intermediary is always a better option as it will take the burden off of your shoulders.

Step 6. Choose a mutual fund distributor. Mutual Fund Distributors help investors to do their paperwork for investing in ELSS mutual funds. They do not charge any fee but make your investment procedure more convenient.

The mutual fund company pays them a commission for this service. It is wise to first pick an ELSS scheme and then approaching a mutual fund distributor.

You can also choose an online distributor. There are several share trading distributors available online. An extra perk with this is that tracking the performance of your ELSS mutual funds becomes easier through the online distributor.

Step 7. Choose an investment option: SIP or Lumpsum. Most of the investors are unable to decide upon anyone. You need to choose the option that suits your needs the best.

For some investors, SIP might be the best option while for others lumpsum seems better. Overall, SIP is more preferred by investors as it is systematic and disciplined.

How to Choose the Best ELSS Funds for Tax Saving: Factors to be Considered While Choosing the Best ELSS Funds

You can’t just go and buy ELSS funds at the eleventh hour. That wouldn’t be quite wise. There are quite a few things you need to consider before making the final decision. Check out the factors listed below before you decide which ELSS mutual fund to invest in:

1. Decide why you want to invest in ELSS funds

ELSS funds are the only mutual fund that invests in equity besides offering tax benefits. Hence, people look at ELSS as a tax planning option only. But, you need to be careful because not all ELSS schemes that offer high tax savings provide good returns.

If all you want to do is save taxes, then you can look at several other investment tools under Section 80C. But, ELSS offers many other benefits too.

So, before you choose to invest in ELSS, make sure that your intention is to achieve your financial goal. ELSS funds can help you to save a large amount besides helping you to save on taxes.

2. Decide upon an investment option: SIP or Lumpsum

Many people opt for an ELSS fund at the last moment to save taxes. This way, they commit to making the entire investment in lumpsum. The reason being that in such a rush to avail of the tax benefits, lumpsum investment is the only option left at that time.

This is quite risky especially if someone invests when the market is high. So, it is advisable that your plan ahead. Besides, ELSS tax saving mutual funds are used for long-term wealth growth, hence, SIP will help to lower down the buying cost per unit of the fund.

3. Compare past performances

While selecting the funds, compare the history and the past performance of 3, 5, and 7 year periods of the funds. It is not guaranteed that past performance will be reflected in the future. But, the past performance and returns of the funds will help in analyzing how these funds coped with different market conditions.

4. Dividend or Growth option

It is advisable to opt for the growth option because that will benefit you from the power of compounding. The dividend option is a bit risky as they are taxable as per your tax slab.

5. Direct Plan for higher returns

If you want higher returns, then go with the direct plan. The direct plans have a lower expense ratio as compared to the growth plan. So, the savings produced from the fund will stay invested in the fund only, and thus, even higher ELSS returns will be generated in the long run.

6. Investment Tenure

ELSS funds are preferred over PPF or NSC because these have a shorter lock-in period of 3 years only. But, equity investments generally need about five to seven years to be stabilized. So, it is advisable to invest in ELSS tax saving funds for a longer than the 3 years lock-in period.

Drawbacks of ELSS funds

There are plenty of benefits of investing in ELSS funds. But, there are some setbacks to ELSS tax saving funds as well. Here is the list of problems with ELSS funds:

- Investing in ELSS requires plenty of documentation.

- ELSS funds are equity-based investments, so the returns are dependent on the status of the market and its performance. For example, if the market crashes, then the return on your investment will be pretty low.

- ELSS is an equity-based fund and equity-linked savings schemes would not allow premature withdrawal.

- The NRIs are barred from investing in most of the schemes.

- ELSS tax saving fund is riskier than NSC and PPF.

Other tax saving investment options

Apart from ELSS mutual funds, other investment tools like tax-saving FDs, NSC, PPF, and NPFs are also good tax saving options you could consider.

Tax-Saving FDs

Tax saving FD is a type of the Fixed Deposit scheme (FD) that offers a tax deduction under Section 80C. You can claim a maximum of INR 1.5 lakh tax deduction with this investment. However, the interest you earn on it is taxable and the lock-in period of tax-saving FD is 5 years.

National Savings Scheme (NSC)

This is a fixed return scheme that is backed by the Government and involves very low risk. You can purchase this scheme from any Indian Post Office. You can buy an NSC if you want to diversify your portfolio via a fixed return investment tool.

Provident Pension Fund (PPF)

The PPF scheme is an extremely famous tax saving investment method in India. Public Provident Fund (PPF) has an EEE status. This means that all the money you deposit in a PPF account, the interest you earn on it, and the maturity proceeds are not taxable.

PPF has a maturity period of 15 years but partial withdrawals can be done every year after 7 years are completed. You can also extend the investment period further by 5 years.

National Pension Scheme (NPS)

The National Pension Scheme provides tax benefits under various sections: Section 80C, Section 80CCD, etc. This is an excellent way to build a corpus for one’s retirement and achieve other long term financial goals.

Comparison of ELLS Funds with Other Tax-Saving Investment Options

[table id=5 /]

Best Performing ELSS Funds of 2019

[table id=6 /]

Source: Valueresearchonline.com

FAQs about ELSS Funds

1. Is it better to invest in ELSS via lump sum or in instalments?

Ans. It depends on you and whichever method is convenient for your situation. However, most people prefer to SIP investment while buying an ELSS. This is because you with SIP, you can avoid the risk of losing your entire investment in case the market crashes.

2. What is NAV?

Ans. Net Asset Value (NAV) of a fund is the price per unit of that mutual fund on a specific day. At the time of withdrawal, the amount deposited to the investor’s account is the product of the number of units available for withdrawal and the applicable NAV price on that day.

3. What is the maximum investment that can be made in these funds?

Ans. The investment amount does not have any upper limit in the case of ELSS. It depends on you and how much you wish to invest.

4. Does a high NAV indicate that the fund is good?

Ans. No, that is not necessary. A proper way to find the best ELSS funds to invest in is to go through the returns provided by it in the past. Besides, you can also compare the rating of the fund with credit rating companies such as CRISIL.

5. What is the minimum amount that can be invested in ELSS?

Ans. You can start ELSS investment with as low as INR 500 only. This option is provided by most of the mutual fund providers but the minimum investment figure might vary from one MF provider to another.