The online gambling industry in India is growing in leaps and bounds. More and more players are taking a keen interest in online gambling. The reason behind the rise is the improvement in internet speed connectivity at an affordable cost. So, they are now able to access online casino games at high speeds which wasn’t the case a decade ago.

Many people ask questions regarding the legal online casinos in India and how much tax a person pays to the government after winning a decent amount. So, a player needs to be aware of the taxes when they indulge in gambling in India. Let’s get started with the taxes associated with online gambling in India.

Taxes Involved in an Online Casino in India

The earning of a player from an online casino is a part of your annual income. Thus, your income will be taxable in all states in India. The income has to be declared under the category ‘Income from other sources.’

You can check the tax details about these incomes under section 115BB of the Income Tax Act. In this section, you will find the details of the wins from casinos, betting, and similar sources.

Whatever you earn from gambling has a tax rate of 30% regardless of the tax bracket you fall under. There are no exemptions on this amount. You have to disclose the earnings in the annual tax filing report.

An additional cess charge is also levied over the tax amount. So, after including the cess, the rate stands at 31.2%. A 4% cess is added to the tax payable by someone whose income is liable for the income tax.

TDS Deducted by Online Casinos Deposited with Indian Government

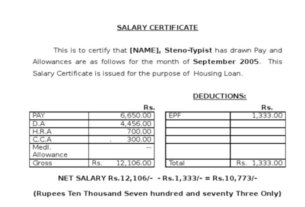

Online gambling operators who are allowed to operate legally in the country will find their tax amount deducted automatically when a player makes a withdrawal from the site. It is a part of the Tax Deducted at Source policy.

For instance, if you win 10,000 INR or more in a single round and want to withdraw your winnings, you will get the money after 31.2% tax deduction under section 194B.

But if you are playing in an international casino that doesn’t have a legal presence in India, you will be provided with the complete winning amount as you make the withdrawal. So, you alone will be responsible for reporting the wins as income on the annual tax report.

With More Wins, Comes More Taxes

According to the Indian tax rules, the added surcharge is applicable to wins of over 50 Lakh Indian rupees. Any win that exceeds 50 lakh will attract a surcharge amount of 10% on the normal rate. This means the tax rate will be 33% excluding cess. So, the total tax rate including the cess stands at 34.32%.

If your wins exceed a crore, a surcharge of 15% will be levied on the regular rate. After adding the cess, the total tax rate is going to be 35.92%.

Is Every Gambling Wins Traced and Taxed?

In India, there is a popular distinction between the Game of Chance and the Game of Skill. According to The Public Gambling Act, any gambling activity involving putting money or any other equivalent is taken to be illegal. But games, where skill is required, are the only exception to the above rule and are taken to be legal.

So, there are a few platforms and games that are not completely legal but aren’t still outlawed. But Income Tax states that all gambling wins should be taxed, there is no distinction between Game of Chance or Game of Skill.

Bottom Line

To engage in online gambling legally, it is important to disclose your exact income from the online casinos. This income needs to be reported when you file your income tax returns.