Last Updated on 09/01/2024 by Pardeep Garg

A Salary slip or Payslip is an important document given to the employee by the organization they are working in to provide a detailed salary structure format. A salary slip is an essential document required to avail of various benefits such as tax deductions. Moreover, it helps you get an idea of the overall breakdown of your salary and its various components.

If you don’t know properly what is a salary slip or what is a payslip, then you are in luck. This article will tell you everything about a salary slip including components, payslip samples, salary slip format template, etc. Furthermore, you will also learn how to create a salary slip in all formats (excel, pdf, and Word). So, let’s get started with it!

In the article

What is a Salary Slip?

A salary slip is a document issued by an organization to its employee that comprises a list of his various salary components like basic salary, HRA, LTA, Bonus, TA, DA, taxes and deductions etc. as well as specific details of his employment. A salary payslip is very vital since it is the legal proof of the salary payments and deductions.

You are required to show your employee salary slip whenever you are applying for loans, credit cards, or for paying income tax amount every financial year, etc.

Salary Slip Format in India

The employee payslip format could be very different for different organizations. But, all salary slip formats are supposed to contain some general heads. So, here are the main employee salary slip components that almost all kinds of payslip formats include:

- Company name, logo and address (on letter pad)

- Payroll slip month and year, Employee Code

- Employee PAN Card/Aadhar Card, Bank account details

- EPF Account Number, Universal Account Number (UAN)

- Total work days, effective workdays, number of leaves taken

- List of payments and deductions

- Gross pay and Net pay in numbers and words

Download Salary Slip/Payslip Sample Format or Template

Download Salary Slip Format In Excel, Word, PDF here

Salary Slip Format in Excel:

Download Salary Slip Format in Excel

Salary Slip Format in Word:

Download Salary Slip Format in Word

Salary Slip Format in PDF:

Download Salary Slip Format in PDF

Salary Slip Format in Doc:

Download Salary Slip Format in Doc

Note: Once you download the payslip format (word/excel/pdf), you will be able to edit it as per your requirements. Always Download the Salary slip Format in Excel or Word. Because you can easily edit salary slips in Excel and word format. The salary Slip Format in the PDF version is not editable.

Pro Tip: Salary slip can be downloaded in any of the 3 formats: Salary Slip Format in Word, Salary Slip Format in Excel, and Salary Slip Format in PDF. All are quite helpful when it comes to making a salary slip. But, we recommend going for the Salary Slip Template Excel as it comes with formulas and makes the calculation part even easier.

Who gets a Salary Slip or Payslip?

A salary payslip is provided by an organization to its employees each month. It is shared with the employees in either mail or paper format. However, there are some small organizations, new startup business that may not provide their employees with payslips each month. In such circumstances, you should ask your organization to issue you a salary certificate.

Importance of a Salary Slip

Read these points to know the Salary Slip Importance in India

1. Helps in planning income tax payments

A salary payslip lays down the foundation for calculating income tax. It helps in preparing income tax returns and in determining how much tax the employee should pay or how much refund he/she can claim every financial year.

2. Proof of employment

Pay slip serves as legal proof of employment. If you are applying for visas to travel abroad or seeking admission to executive programs at numerous universities, you might be asked to provide copies of your employee salary slip as proof of your employment and designation.

3. To apply for loans/credit card

Salary payslip comprises details of your monthly income that determines your capacity to meet your debt liabilities. Hence, your pay salary slip is essential while applying for loans, credit cards, and other borrowings.

The institutions from which you are to borrow money will ask you for a copy of your salary slip. In addition to helping them judge your creditworthiness, your salary slips also helps them fix your credit limit. Moreover, providing your last 3 months’ salary slips is a basic criterion of almost every institution for providing you with loans.

4. Helps in assessing job offers

Employees can compare job offers coming from new organizations depending on their previous pay slips. It enables them to negotiate salaries with new organizations or for new job roles.

5. Gives access to several other facilities

An employee salary slip permits employees to access several subsidized facilities that are provided by the government of India like health care, food grains at subsidized rates, etc.

6. Helps in Understanding the Payslip Breakdown

Your pay salary slip consists of several components such as EPF, ESI, and so on. These are mandatory contributions cut from your salary every month for savings. Other details like your allowances and your actual take-home salary are also mentioned in the salary slip. You must know these details to be able to use them to your benefit as and when required.

7. To Figure Out Your Savings For Retirement

As mentioned in the above salary slip template in Excel, you will find both your and your employer’s contribution towards your PF. As you might be aware that Provident Fund (PF) is a type of retirement fund. This way, you will be able to receive a clear idea of how much money will be amassed in your PF account when you retire. It will help you decide if you need another backup plan for retirement or not in case the maturity amount isn’t enough to support your lifestyle needs.

YOU MAY LIKE TO READ: Best Banks For Saving Account In India

How does Salary Slip Help to Save Income Tax?

A monthly pay slip contains several components like House Rent Allowance (HRA), Dearness Allowance (DA), Medical Allowance, etc. that can enable an employee to save income tax every financial year.

The tax authorities enable organizations to structure the salaries of their employees in such a way that enables them to save tax via several allowances that are included in their income.

Also, every salary slip format pdf contains a head known as Income Tax. This is the tax levied on the resulting amount after all the deductions, as per the employee’s tax slab. For example, if your monthly income is INR 50,000 after all the deductions, then the IT deductions will be levied on this figure.

Taxes can further be saved by making investments in tax-saving instruments such as taking loans, policies, NPS, equities, and so on.

Check here Best Tax saving ELSS Mutual funds to save Income Tax in 2024

Benefits of A Salary Slip

- Salary slip shows the employer the actual cash he/she will get in their hand so that they can get an idea about how much income tax they are required to pay every financial year.

- With the help of salary slips, the employee can find out how much he/she is contributing towards the employee’s provident fund.

- A salary slip is an important factor in determining the employee’s loan repayment capacity and thus determines the loan amount he/she can get.

- Payroll slip is a significant factor when you change jobs or apply for executive programs in any university. Universities and new employers seek salary slips to verify your salary claims.

Important Components of a Salary Slip/Pay Slip

A simple salary pay slip format includes several components such as monthly pay slip salary, types of allowances in salary slip like DA, HRA, LTA, Conveyance Allowance, and other employee salary details format in Excel or word. Find the components of a salary slip template described in detail below:

1. Basic Salary mentioned in simple salary slip format

The basic salary is an important part of your pay slip format as it comprises 35% to 50% of your salary. Mostly, several salary components are calculated as the percentage of your basic pay. Thus, organizations try to keep the basic pay lower so that they do not have to pay high allowances. Basic Pay is low for senior-level and higher for junior-level employees.

Some features of Basic Pay are:

a) It is fully taxable

b) It is a part of the in-hand salary

c) If your basic pay is high, your tax amount will be higher. Basic salary will decide your House Rent Allowance (HRA), Dearness Allowance (DA) and Employee Provident Fund (EPF)

2. Dearness Allowance (DA)

DA is calculated as a percentage of your basic salary and intends to provide cover against the impact of inflation. It is directly related to the cost of living and differs among employees, depending upon their locality.

Some features of DA are:

a) Dearness allowance is fully taxable for salaried employees

b) It is a part of the in-hand salary

3. House Rent Allowance (HRA)

It is an allowance that helps the employee to pay rent if he/she is living in a rented house. If the employee is living in the metro cities then the HRA will be equal to 50% of the basic salary, and for the small cities or towns, it will be 40% of the basic salary.

Some features of HRA are:

a) HRA is exempted from tax up to a certain limit, provided you are paying rent. The exemption amount is calculated as the minimum of:

Rent paid annually (-) 10% of basic pay (+) DA

50% of (Basic + DA) in case the location is in metro cities like Delhi NCR, Mumbai, Bengaluru or Kolkata, and 40% of (Basic + DA) in case of small cities like Mysore, Nagpur, Durgapur, etc.

b) It is a part of the in-hand salary

4. Conveyance Allowance

It is the amount of money that the employer gives to an employee to travel from home to work and vice versa. It is exempted from tax up to a particular limit.

Some features of Conveyance Allowance are:

a) The exemption amount is calculated as the minimum of:

Rs 16,00 per month and 19200 per year.

Conveyance amount component in your monthly salary slip

b) It is a part of the in-hand salary

c) It affects the in-hand salary of those employees who are working at junior levels.

5. Leave Travel Allowance (LTA)

LTA covers the cost of travel when the employee is on leave with his/her family members. To claim LTA, the employee is required to submit proof of travel. Furthermore, LTA is relevant only for two days’ leave in once a year and other expenses during the travel cannot be claimed

Some features of LTA are:

a) Whether you travel alone or with family, LTA is exempt from tax for up to two journeys in a block of four financial years.

b) It is not a part the of in-hand salary

6. Medical Allowance

If an employee meets with an accident or any other type of injuries while he/she is working for the organization then he can claim for the medical allowance. The employee needs to submit proof of all his medical expenses to claim the medical allowance.

Some features of medical allowance are:

a) Medical allowance is exempted up to Rs 15,000 if the employee can submit all the required medical bills.

b) It is not a part the of in-hand salary

7. Performance/Special Allowance

It is an amount offered to an employee by their employer as a reward in case of his/her extraordinary performance. It is really important to motivate the employees and encourage them as much as possible.

Some features of performance/special allowance are:

a) Performance/Special Allowance is fully taxable

b) It is a part of the in-hand salary

8. Tiffin/Meals Allowance

An organization can also provide tiffin/meal allowance to their employees. It is partially taxable.

9. City Compensatory Allowance (CCA)

CCA is paid to the employees by their employers to help them bear the cost of living in urban areas or big cities.

10. Variable Component

The payment slip format consists of a variable component too. And this includes your performance-based bonus or incentive. Generally, the variable component is around 10 to 15% of the entire Cost-To-Company. Keep in mind that the variable component is paid on a half-yearly or annual basis and it is fully taxable.

11. Other allowances mentioned in salary slip format in India

This comprises the various tax-saving allowances paid by an organization for any reason that may help you in claiming an income tax rebate from your annual income.

Some features of these allowances are:

a) These are fully taxable

b) These may or may not be a part of the in-hand salary

Salary Slip Deductions

Every payslip model includes some deductions as well. Here is the detailed elaboration of all the deductions mentioned in your company’s payslip:

1. Employees Provident Fund (EPF)

This component of your monthly pay slip, which is deducted from your salary, is referred to as provident funds. The fund amount that is deducted from your salary is usually 12% of the basic salary that you get after your retirement.

Your contribution towards the Employees Provident Fund is exempted from tax according to Section 80C of the Income Tax Act.

2. Professional tax

This component is levied on all individuals who have an income. It includes salaried, professionals, and traders who earn money. Professional tax is a type of a direct tax that is levied in some states and its calculation is done on the basis of an individual’s tax slab.

3. Tax Deductible at Source (TDS)

TDS is referred to as the amount of tax that is deducted by your organization on behalf of the Income Tax Department. You can reduce the TDS amount by investing in tax-saving schemes and submitting the relevant documents to your organization.

4. Gratuity

Gratuity deduction is mandatory for every employee. This deduction goes towards your gratuity fund. It generally includes a part of your payslip salary and dearness allowance. You can avail the amount collected in your gratuity fund at the time of leaving the company. This is allowed only if you have completed 5 years with the company.

Standard Deduction

Standard Deduction was launched after being reintroduced in the Budget of 2018-19 by the then Finance Minister, Arun Jaitley. As per this protocol, employees could claim a sum of INR 40,000 as standard deduction. So, the taxes levied on the employee would further decrease.

Furthermore, in the Union Budget of 2019-20, the amount that can be claimed under standard deduction was further increased to INR 40,000. However, this figure has taken the place of some allowances like transport and medical allowance in the payment slip format.

How to Read and Understand Your Salary Slip?

Now that you properly know about the several components of the salary slip template, you need to do some more. Go through the following guidelines to understand and utilize your payslip in a better way if you are a new employee:

- Take out your employment agreement and tally all the components in your salary slip with that in the employment agreement.

- Calculate the total number of days in a given month that you have worked for the company. And tally it with the number of days you have been given the salary for.

- Lastly, you need to check the tax deductions.

How knowledge of salary slip increases your take-home salary?

You can increase your take-home payslip salary by following some of the tips stated below:

- The easiest way to increase your take-home payslip salary is by cutting down your basic salary and adjusting it with long-term benefits. A higher basic salary means you need to contribute more to DA, HRA, and Employees Provident Fund. However, reducing your EPF contribution might harm your retirement plan.

- Eliminate special allowances that are fully taxable and adjust it with tax-free benefits.

- Get maximum benefits from travel and medical allowances

- Variable pay is fully taxable, and thus negotiate it to the minimum amount

You May Like to read 10 Best Banks for Saving Account in India with Interest Rate 2020

Differences between Cost to Company (CTC) and in-hand salary

| Cost to Company (CTC) | In-hand Salary |

| Cost to Company (CTC) can be defined as the total amount an organization will spend on an employee during a given year. It is the amount spent on hiring and reimbursing for the employee’s services.

CTC consists of salary, pension, PF contributions, allowances, etc. It is variable and depends on several factors which in turn affect the net salary |

In- hand salary is defined as the amount an employee receives as a monthly salary after various deductions like Income Tax, PF contributions, Professional Tax, etc.

|

Taxable/partially taxable & non-taxable components of salary slip

You will find several heads and sub-heads in the salary slip sample document. Now, it is important for you to know which of these components are taxable and non-taxable. Given below is a table with all the taxability details about the components in your payslip format in excel/ word/ pdf.

| Components | Taxable/Partially taxable/Non-taxable |

| Dearness Allowance (DA) | Fully taxable |

| Basic Pay | Fully taxable |

| House Rent Allowance (HRA) | Partially Taxable |

| Conveyance Allowance | Partially Taxable |

| Medical Allowance | Partially Taxable |

| City Compensatory Allowance (CCA) | Fully Taxable |

| Tiffin/Meals Allowance | Fully Taxable |

| Performance/Special Allowance | Fully Taxable |

| Leave Travel Allowance | Partially Taxable |

| Other Allowances | Fully Taxable |

| Allowances paid by the government to its employees living abroad | Non-taxable |

| Allowances paid to the judges of Supreme and High Court | Non-taxable |

| Allowances paid by UNO to its employees | Non-taxable |

| Allowances to the retired chairman or members of UPSC | Non-taxable |

Legal Validity of Manual & Digital Pay Slips

Salary slips in either manual or digital format hold the same legal position. However, any sort of meddling with a monthly salary slip is a criminal offence.

How to Create Salary Slip Online in Easy Way?

When employees are paid in addition to their ordinary hourly rate formwork performed over a standard shift the amount of money paid appears on the Payment Slip sample. Now that you know how important monthly salary slip is, you must download a payslip template to proceed. It’s very simple! Just follow these steps and get your format of salary slip.

- Download Salary Slip Format in Excel, Word, PDF file.

- After Payslip Format Download is complete, choose a period for which you want your employee Salary Slip indicated against the year and month.

- Fill your organization details, Employee ID, Company Name, Designation, Company Address, Phone No Etc. in the payslip sample.

- Enter details of your employee Salary components whichever applicable.

- Enter your PAN.

- Now save your file and take a printout on paper with the organization letterhead

- Also, don’t forget to get it verified by the HR head with the organization stamp and signature.

Now, this was a demonstration of how one can download and edit the employee monthly salary slip. The process is the same, more or less, for all types of salary slip format. There are various kinds of salary slip formats in Excel, Word and PDF available on the internet.

For example, salary slip format in excel with formula You can go to your employing company’s website. And, follow a similar process to obtain your Pay Slip format.

What is Salary Certificate? How is it different from a salary slip?

The salary certificate is a verified document that is issued by the head of an organization to its employee to prove his employment. It validates the relation of the employee with the organization he is working for a given period in return for salary payments.

A salary certificate is different from a salary slip in the following ways:

- A salary certificate might not show the detailed break-up of the monthly salary an employee receives, whereas the employee payslip furnishes a detailed break-up of income and deductions made in the monthly salary.

- The salary certificate confirms proof of employment but does not indicate the financial status of an employee. On the other hand, salary payslip not only confirms proof of employment but also gives a complete idea of the financial status of an employee.

Conclusion

Now, you must have received a clear idea of all the components of a salary slip format and how all of that matters. We have tried our best to incorporate everything you need to know about a salary slip including its format, benefits, components, and much more. Salary slip format download links are also provided in the article.

You have the full right to know about the various components of your hard-earned money and that is possible only via a Payment slip. It is your proof of employment and is needed for loan/credit card applications, income tax payments, and to access several other important facilities.

So, you must not take your salary slip lightly and use it wisely for various aspects like your tax deduction, grabbing a better job, and more long-term benefits.

Salary Slip FAQs

Q: How to check my Salary Slip online?

Answer – First you have to ask your company whether it has its online portal or not.

- Suppose If your organization is having an online portion then visit the website of your firm and login into it.

- Then check Employee Self Service then it will provide online access to each employee’s payslip.

- Users can see a list of payslips organised by salary period.

- To examine a payslip for a certain salary period, simply click on it.

- And If your firm doesn’t have an online portal then sorry you cannot check your salary slip online.

Q: How do I verify my payslip?

Answer – If you have any doubt in your payslip or salary you can simply ask your Human Resource Officer about it. He will solve your problem.

Q: How do I download my payslip?

Answer – Visit your organization online portal and then go to Employee Self Services.

- Click on the “View Payslip” and choose the month for which you want your payslip.

- Now check your name and mark the check box in front of your name.

- Click on the download button.

Q: What is e salary?

Answer – e- Salary provides you the facility to process and publish the salary of the employees of the department. It facilitates all the reports needed for the account branch. Individual employee can see his salary slip, annual salary statements and payments.

Q: Can HR verify salary?

Answer – Yes, He can verify salary.

Q: Can I edit my payslip?

Answer –No, you cannot edit your payslip. You can only view and download your payslip.

- If you have any kind of issue or doubt you can easily consult with your Human Resource Officer.

- Or if you are making corrections in your payslip by yourself with the help of third party sources then you need the authenticity and signature of that party and then you have to run it by your HR.

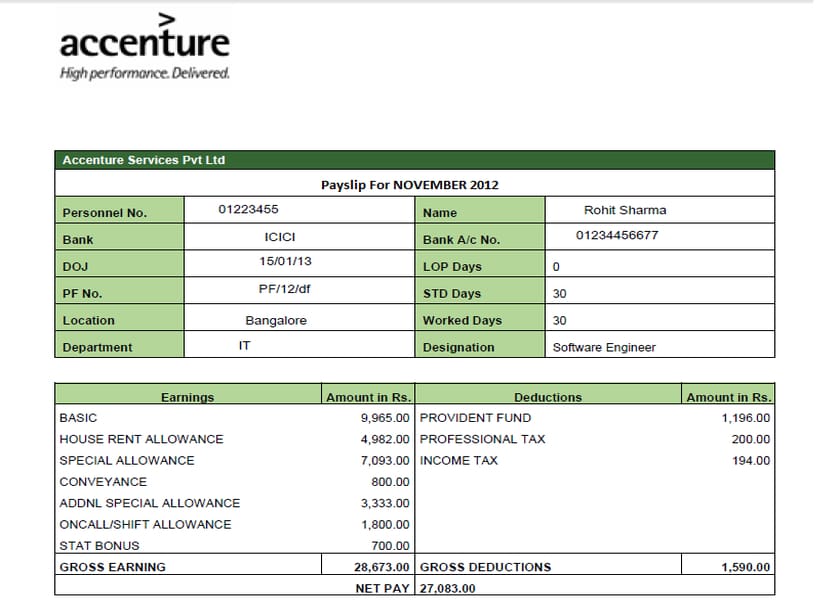

Q: What does a salary slip look like?

Answer – Here is a sample of salary slip.

Q: When must I get my payslip?

Answer – Payslip law specifies that your employer must provide you with your payslip on or before the day you are paid. This depends on the type of company you work for; some companies pay on the same day every month, while others pay every four weeks.

Q: Is it illegal to not give employees a payslip?

Answer – Payslips are required by law under ((Minimum Wage (Central) Rules, 1950, Rule 26(4) and Minimum Wage (Central) Rules, 1950, Rule 26(3)). If your employer fails to provide you with a payslip, they are breaking the law.

Q: How can I check my salary in Haryana?

Answer – These points you have to follow to check your salary in Haryana-

- Login to the Haryana esalary site at esalaryhry.nic.in.

- Authorized Login is located at the bottom of the page.

- As the Employee Code, enter your Username.

- Enter your Password, which will be generated during the sign-up process.

- Choose a year.

- Fill in the Captcha code in the adjacent box.

- Wait until your credentials are verified before clicking the Login button.

- This is the place to be. To view your information, go to the Main Menu and select Edit Profile.

- After you’ve double-checked your information, go to the Menu and select Reports.

- To view your pay stub, select it from the drop-down menu.

- Choose your pay month and year from the drop-down menus.

- Wait for the PDF to load after clicking Generate report.

- Each month’s Pay Slip is contained in a PDF file that you may download to your hard drive using the download option.

Q: How do I edit a salary slip in Word?

Answer –

- To import a file from the cloud or your device, use the Add button.

- Choose a conversion method.

- The conversion begins quickly, and once complete, touch on the file to open it in any Word software.

- Use Word or another text editor to alter your payslip document.

Thanks Really easy to download salary slip

Good Read! Pradhan Mantri Mudra Yojana is a financial initiative for facilitating and motivating micro-units and providing them with sufficient funds to help them and to develop their business.

Thanks for sharing the payslip format. I was looking for it. Enjoyed reading salary components detail as well.